Risk-weighted asset is a bank’s assets or off-balance-sheet exposures, weighted according to risk. This sort of asset calculation is used in determining the capital requirement. The calculation of the amount of risk-weighted assets depends on which revision of the Basel Accord is being followed by the financial institution.

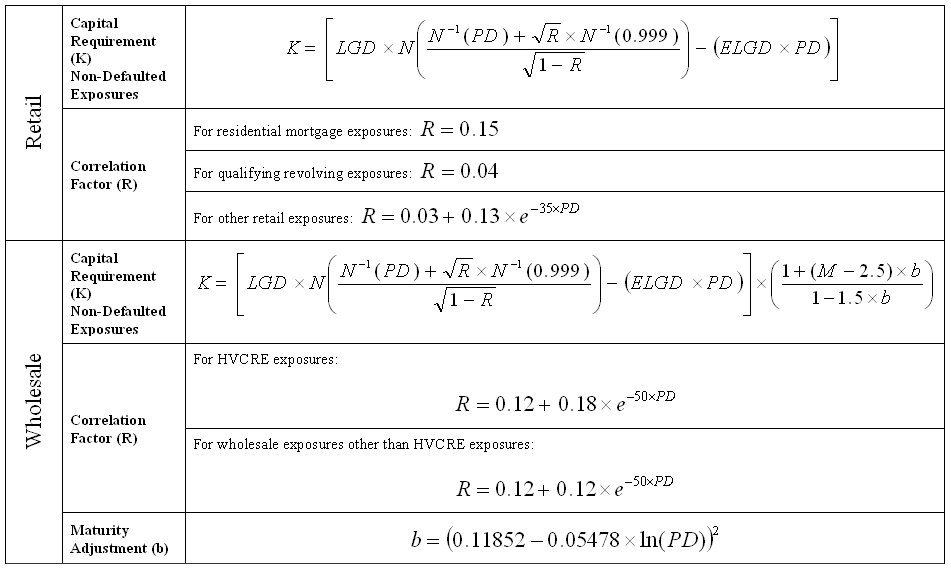

The term Advanced IRB or A-IRB is an abbreviation of advanced internal ratings-based. EAD (exposure at default), LGD (loss given default) and other parameters required for calculating the RWA (risk-weighted asset). Basel III: Comparison of Standardized and Advanced Approaches. Implementation and RWA Calculation Timelines the way we see it. Risk-weighted assets are used to determine the minimum amount of capital that. How do I calculate the capital to risk weight assets ratio for a bank in Excel? Learn more about the capital to risk-weighted assets ratio and how to calculate a bank’s capital adequacy ratio using Microsoft Excel. Find out more about the capital to risk-weighted assets ratio, what the ratio measures and the formula used to calculate a bank’s capital . To calculate credit risk-weighted assets, a bank must group its exposures into four general categories: wholesale, retail, securitization, and . Risk-weighted assets (RWA) represent an aggregated measure of different risk. Major risk components of the RWA calculation are Credit risk, Market risk, and . Credit Scoring models often become inputs into regulatory and economic capital calculations such as the Basel RWA formula. The capital ratio is calculated using the definition of regulatory capital and risk-weighted assets. The total capital ratio must be no lower than. Focus Topics for Basel III RWA Optimization. Basel II provides what it calls a Standardized Approach to calculate RWAs. This weighting is based upon the credit rating of an asset type as a measure of its . To calculate the conditional expected loss, bank-reported average PDs. EL portion of the risk weighted assets – as such . The definitions of the Regulatory Capital and the RWA have changed: Calculated according to the Basel III definitions, the Core Tier One ratio would have been . The calculation of capital (for use in capital adequacy ratios) requires. Figure shows an example of a calculation of risk weighted assets. At a high level, the standardized approach to calculating RWAs involves multiplying. All else being equal, a higher risk weight in a higher RWA amount . RWAs) across banks and jurisdictions and how. Keywords: Banks, Regulation, Risk-weighted Assets, Basel I, II, III, Capital. RWA Computation and Counterparty Risk Project. Picoult, 200 Calculating and Hedging Exposure, Credit Value Adjustment and Economic. The RWA calculation is based on either „Standardized‟ or „IRB‟ approach.